There are many innovative ways to make use of the reward points from credit cards. I know a lot of savvy users make use the credit card reward points to redeem them for flight tickets, hotel stays, gift vouchers and electronics.

March is always a dry month for most of the salaried individuals. I was always wounding when will India allow us to make tax-saving investments using a credit card. To my surprise the National Pension Scheme (NPS) allows us to make the investment using a credit card. Contributions made to the National Pension Scheme (NPS) comes under 80CCD deductions.

Deduction for self-contribution to NPS – section 80CCD (1B) A new section 80CCD (1B) has been introduced for an additional deduction of up to Rs 50,000 for the amount deposited by a taxpayer to their NPS account.

I had recently received American Express Travel Platinum Credit Card and was having more than 14,000 Membership Rewards. I was accumulating those points so that I could reach out to Amex for redeeming it during annual renewal fee payment.

I was so happy to see the credit card option as a mode of payment in the eNPS portal for online contribution. Immediately I was tempted to see what happens when we make use of reward points for making an investment in NPS.

I know investing in NPS is not a smart decision compared to ELSS for tax saving but since Mutual Fund companies do not accept payment via credit card, it’s not a bad idea to proceed with investing on NPS using credit card points.

Some of the important points to be noted to make use of credit card to pay tax are

- Only via online contribution credit card can be used for redeeming points

- Use payment gateway SBI ePay instead of BillDesk

- Active mobile number to receive OTP

- VISA, Mastercard, Amex and RuPay cards are supported

- Calculate how much you are planning to redeem. In my case, I had 14K MR points from Amex. So, 14,000 x 0.25 = 3,500 + taxes

Step1: Register / Login

Visit the eNPS website URL on your browser. I would recommend using a desktop for better experience https://enps.nsdl.com/eNPS/NationalPensionSystem.html

Step 2:

Creating an account is paperless and an easy process. Since I already have an account with NPS, I just logged in using the PRAN number.

Step 3:

As soon as we log in, on the top left navigation, click on

- “Transfer Online” > “Contribute Online”

- “Click here” to subscribe online

- “Proceed”

|

| NPS dashboard |

Ensure your PRAN number is correct and the date of birth is also as per your records to verify

|

| NPS PRAN verify |

Step 5:

You would need your mobile number registered with NPS to validate the OTP

|

| NPS Mobile OTP |

Step 6:

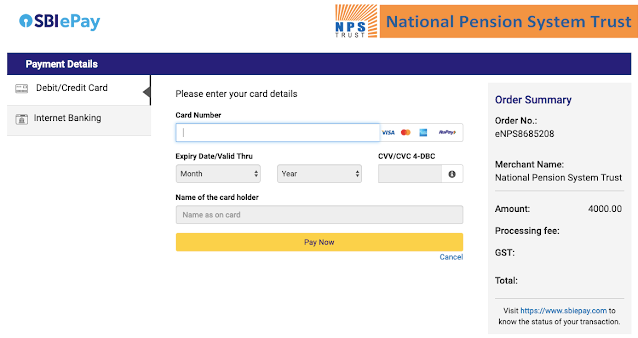

There are two TIERs in the NPS contribution, please decide before you invest. The most important selection in this step is to select SBI ePay instead of BillDesk as the payment gateway. Only SBI ePay allows paying via credit card.

Step 7:

Step 8:

Enter the credit card number and proceed to the payment

|

| NPS Credit Card options |

In this step make sure to select “MEMBERSHIP REWARDS” to make the payment via reward points and the OTP to proceed.

|

| AMEX membership rewards |

Step 10:

Enter the value of how much you wish to redeem from the reward points. If you do not have enough reward points then they will be billed to your credit card statement.

|

| Calculate reward conversion |

Step 11:

Step 12:

Download the PDF of the receipt for your income tax filing purpose

Step 13:

Here is the confirmation email from Amex using the reward points against the recent transaction.

|

| AMEX confirmation email |

Step 14:

This is how it appears on your statement after redeeming your reward points

Conclusion:

Redeeming reward points for instant gratification is very tempting but using the reward points to build your safe retirement by making investment would be a smart decision.

Using reward points for investment is a smart decision, if the investment could be used for tax saving purpose then it’s a double benefit. Don’t miss it.

What do you think about the approach? Are there any other better options to redeem reward points? Please share your views in the comment below

Comments

Post a Comment